USDA Unveils Second Round of Trade Facilitation Payments

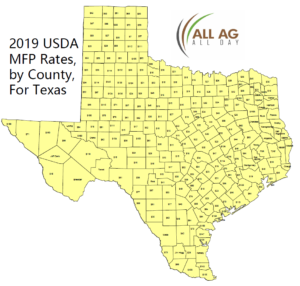

(WASHINGTON, DC) Agriculture Secretary Sonny Perdue announced details regarding a $16 billion package aimed at supporting American producers while the Administration, he says, continues to work on free, fair, and reciprocal trade deals. The Market Facilitation Program (MFP) will be implemented by USDA’s Farm Service Agency (FSA) with signup beginning Monday, July 29th (and ending December 6th). Payments will be made under the authority of the Commodity Credit Corporation (CCC) to producers of alfalfa hay, barley, canola, corn, crambe, dried beans, dry peas, extra-long-staple cotton, flaxseed, lentils, long grain and medium grain rice, millet, mustard seed, oats, peanuts, rapeseed, rye, safflower, sesame seed, small and large chickpeas, sorghum, soybeans, sunflower seed, temperate japonica rice, triticale, upland cotton, and wheat. MFP assistance for those non-specialty crops is based on a single county payment rate multiplied by a farm’s total plantings of MFP-eligible crops in aggregate in 2019. Those per-acre payments are not dependent on which of those crops are planted in 2019. A producer’s total payment-eligible plantings cannot exceed total 2018 plantings. County payment rates range from $15 to $150 per acre, depending on the impact of unjustified trade retaliation in that county.

(WASHINGTON, DC) Agriculture Secretary Sonny Perdue announced details regarding a $16 billion package aimed at supporting American producers while the Administration, he says, continues to work on free, fair, and reciprocal trade deals. The Market Facilitation Program (MFP) will be implemented by USDA’s Farm Service Agency (FSA) with signup beginning Monday, July 29th (and ending December 6th). Payments will be made under the authority of the Commodity Credit Corporation (CCC) to producers of alfalfa hay, barley, canola, corn, crambe, dried beans, dry peas, extra-long-staple cotton, flaxseed, lentils, long grain and medium grain rice, millet, mustard seed, oats, peanuts, rapeseed, rye, safflower, sesame seed, small and large chickpeas, sorghum, soybeans, sunflower seed, temperate japonica rice, triticale, upland cotton, and wheat. MFP assistance for those non-specialty crops is based on a single county payment rate multiplied by a farm’s total plantings of MFP-eligible crops in aggregate in 2019. Those per-acre payments are not dependent on which of those crops are planted in 2019. A producer’s total payment-eligible plantings cannot exceed total 2018 plantings. County payment rates range from $15 to $150 per acre, depending on the impact of unjustified trade retaliation in that county.

Dairy producers who were in business as of June 1, 2019, will receive a per hundredweight payment on production history, and hog producers will receive a payment based on the number of live hogs owned on a day selected by the producer between April 1 and May 15, 2019. MFP payments will also be made to producers of almonds, cranberries, cultivated ginseng, fresh grapes, fresh sweet cherries, hazelnuts, macadamia nuts, pecans, pistachios, and walnuts. Each specialty crop will receive a payment based on 2019 acres of fruit or nut-bearing plants, or in the case of ginseng, based on harvested acres in 2019. The acreage of non-specialty crops and cover crops must be planted by August 1, 2019, to be considered eligible for MFP payments. Per-acre non-specialty crop county payment rates, specialty crop payment rates, and livestock payment rates are all currently available on farmers.gov.

MFP payments will be made in up-to three tranches, with the second and third tranches evaluated as market conditions and trade opportunities dictate. If conditions warrant, the second and third tranches will be made in November and early January, respectively. The first tranche will be comprised of the higher of either 50 percent of a producer’s calculated payment or $15 per acre, which may reduce potential payments to be made in tranches two or three. USDA will begin making first tranche payments in mid-to-late August. MFP payments are limited to a combined $250,000 for non-specialty crops per person or legal entity. MFP payments are also limited to a combined $250,000 for dairy and hog producers and a combined $250,000 for specialty crop producers. However, no applicant can receive more than $500,000. Eligible applicants must also have an average adjusted gross income (AGI) for tax years 2014, 2015, and 2016 of less than $900,000 or, 75 percent of the person’s or legal entity’s average AGI for tax years 2014, 2015, and 2016 must have been derived from farming and ranching. Producers who filed a prevented planting claim and planted an FSA-certified cover crop, with the potential to be harvested qualify for a $15 per acre payment. Acres that were never planted in 2019 are not eligible for an MFP payment.