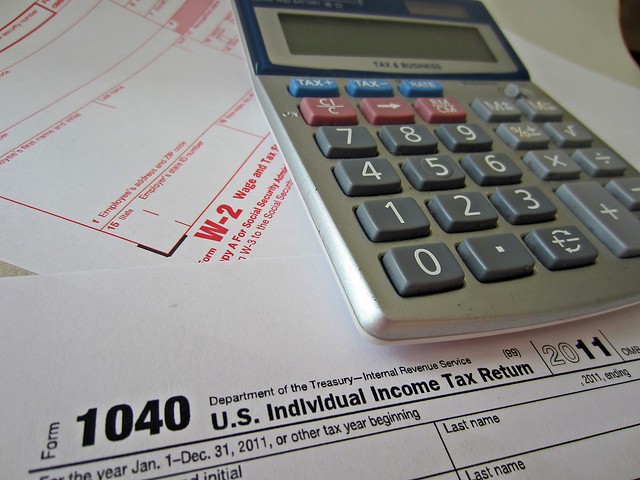

Tax Policy Affects Ag Industry Differently Than Others

WASHINGTON, DC – As the debate on tax policy heats up in Congress, one economist warns that agriculture is not on equal footing with other industries. Scott Gerlt is an economist with the American Soybean Association (ASA) and explains that production agriculture is an asset-intensive sector whereby the projected five-year average return on assets is less than 3 percent, while the same average for the S&P 500 is almost 8 percent. This is an indication that the typical S&P500 firm requires about one-third of the assets of an average farm to generate similar profits. For capital gains, utilizing a “stepped-up” basis in agricultural operations is vital. This allows a reset during an intergenerational transfer that establishes the value of an asset at its current value, instead of a capital gain, or the difference between what was paid for the asset and what it’s worth today. Again, for agriculture, the biggest challenge is the transfer of land which could easily wipe out a family farm that bought cropland less than 30 years ago, since a 20 percent tax bracket for a family earning $80,000 per year would be exceeded with just 81 acres of land. One of the issues created by the capital gains tax without the stepped-up basis is that of market inefficiencies, Gerlt outlines. The capital gains tax is incurred when the asset is sold therefore, the supply curve for assets is shifted backward with the tax, which reduces the amount of supply available at any given price. Four things happen with this change: 1) sellers net less value from the sale than before the tax, 2) buyers must pay more, 3) the government realizes the tax as income, and 4) society realizes a net loss in overall welfare. The exact amounts of each of the components depend upon the responsiveness of sellers and buyers to prices.

(SOURCE: All Ag News)