Fed Preparing Rate Cut Amid Declining Loan Demand

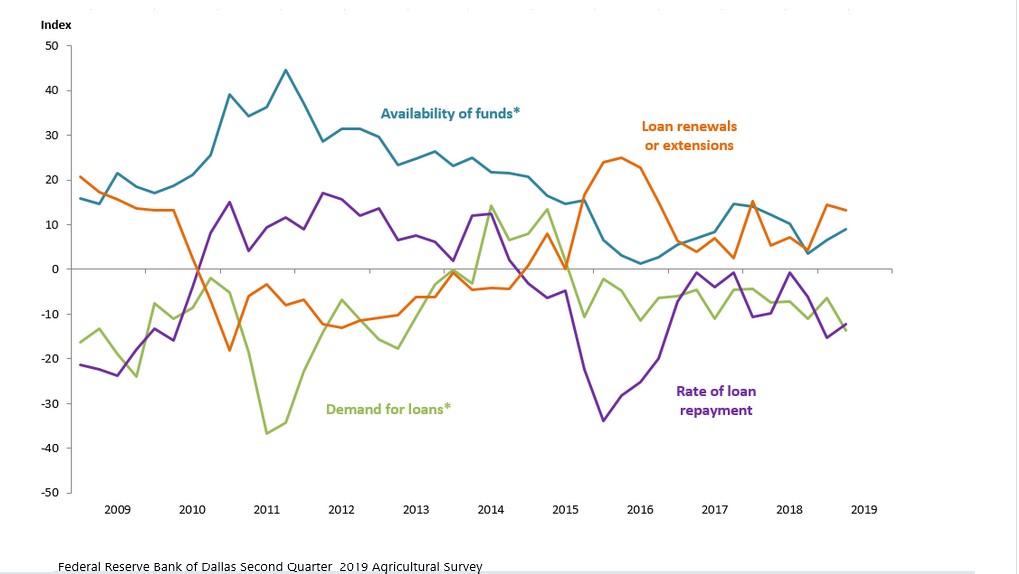

(DALLAS, TX) Testifying before the House Financial Services Committee on Wednesday, Federal Reserve Chairman Jerome Powell said he doesn’t “expect a severe downturn” in the near future, but warned that a “cross-current” of trade uncertainties and slowing global growth could require a more accommodative monetary policy stance. Powell’s remarks come ahead of a Federal Open Market Committee meeting this month that could see the Fed’s first interest rate cut in a decade. The testimony comes as the Federal Reserve Bank of Dallas says bankers responding to the second-quarter agricultural survey reported overall weaker conditions across most regions of the Eleventh District. They noted that heavy rainfall in the quarter had mixed effects, with some corn crops benefiting but other crops, particularly cotton, negatively impacted. Demand for agricultural loans plummeted, with the loan demand index falling to its lowest reading in six years. Loan renewals and extensions increased, and the rate of loan repayment continued to decline. With the exception of operating loans, loan volume fell across all major categories compared with a year ago. District ranchland and dryland values increased notably, while irrigated cropland values held steady. The anticipated trend in farmland values index was mostly flat for a third consecutive quarter, suggesting respondents expect farmland values to hold steady. The credit standards index fell slightly but remained elevated, indicating further tightening of standards on net.