Farm-State Senator Warns Against Wrecklessly Approving More Stimulus

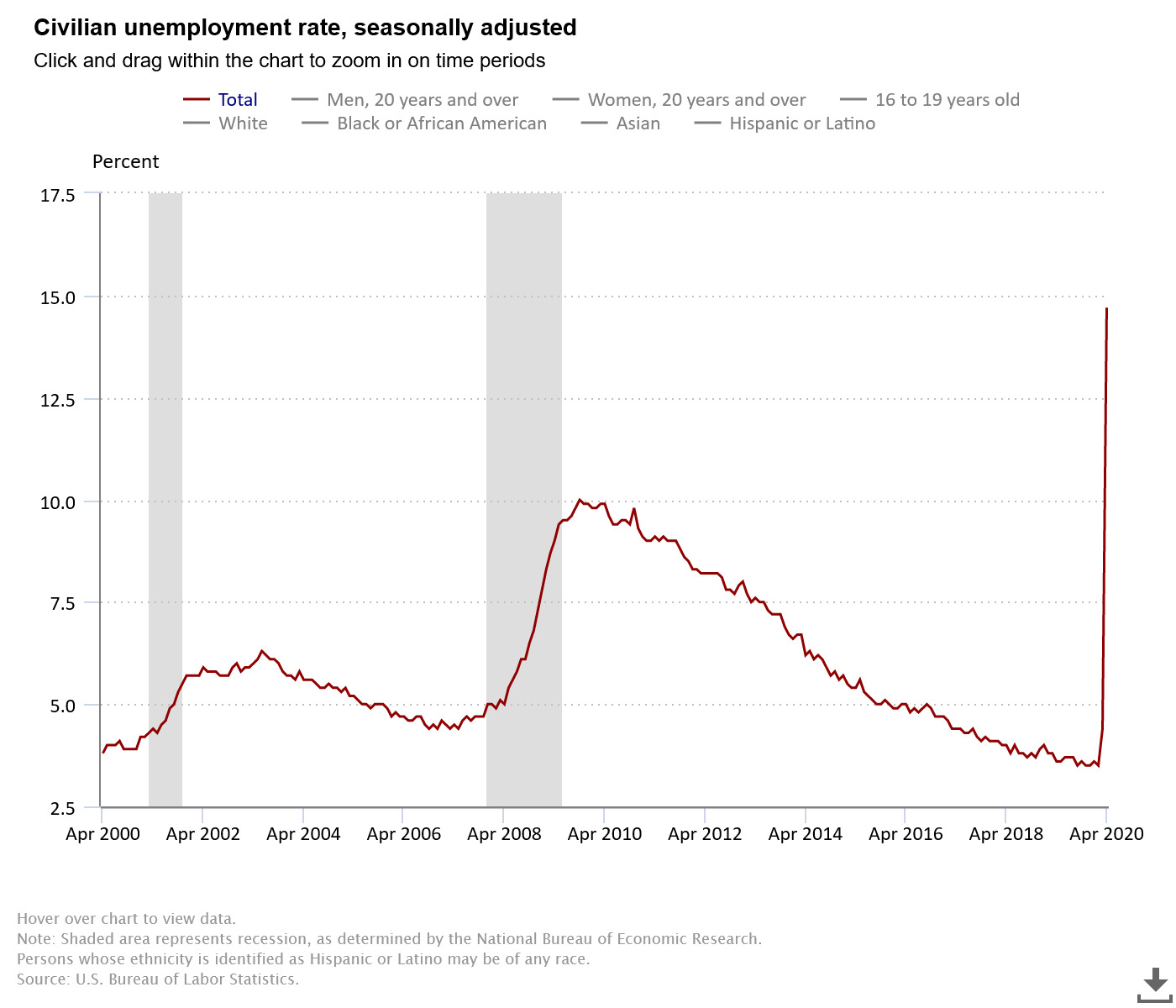

WASHINGTON, DC – The unemployment rate rose to 14.7 percent in April, reflecting the effects of the COVID-19 government lockdown, and the worst rate since the Great Depression. According to the Bureau of Labor Statistics, employment fell sharply in all major industry sectors, with the heaviest job losses in leisure and hospitality. This is prompting more calls on Congress to pass additional Stimulus packages aimed at restarting the economy. Sen. John Thune (SD), a member of the Senate Agriculture Committee, says that as custodians and stewards of the peoples’ tax dollars it’s important to ensure the previous investments are having the desired effect. Legislators need to determine what the actual need is before sending any more money he explained, “and by the way, more money that is all borrowed.” Every dollar of the $2.8 trillion that has been distributed, and all for good reasons, is borrowed “which means at some point somebody has to pay for it.” He does agree that low-interest rates are good if you have to borrow, “but if we continue to borrow there’s a point at which interest rates will start to go up and when they do there will be a dramatic increase in the amount used just to pay the interest on the debt.” If rates never normalize – the best-case scenario for the government – the interest would be north of a $1 trillion a year and would represent literally 28 percent of all federal spending.”