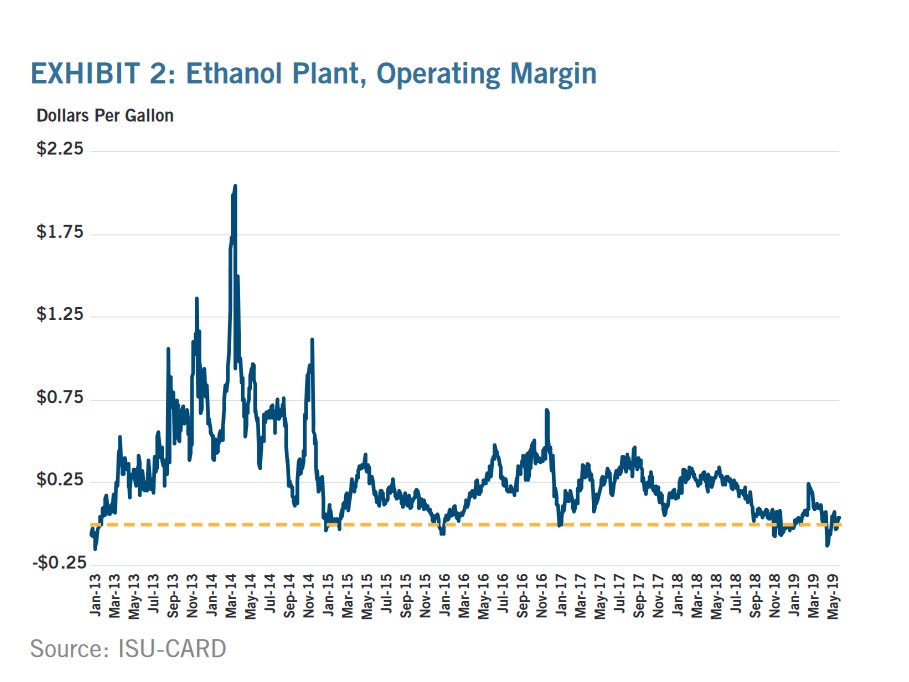

Ethanol Plants Expecting Weaker Margins Amid Declining Demand

(GREENWOOD VILLAGE, CO) After several years of positive margins, ethanol plants have been expanding capacity. Ample production and relatively stagnant demand growth have weakened ethanol margins. Today, the industry is trying to work through and absorb this excess production. Margins began sliding last summer and plants have struggled to remain profitable ever since. With stocks expected to remain above 900 million gallons through the remainder of 2019, margins will remain low. According to CoBank, supply and demand need to come into better balance in order to see a pop in margins. “This will be a painful process for some higher-cost producers as they look to reduce production or exit the industry” explains Will Secor, an economist for CoBank’s Knowledge Exchange. If the plants can be run profitably with lower financing costs, other ethanol producers with strong balance sheets may purchase these assets Thus, consolidation and a slow grind to higher margins will be the theme of the coming years. Persistent, low margins will also drive ethanol plants to diversify revenue. One could expect co-product offerings to expand and investments in these co-product lines to increase. These co-product investments may include equipment to produce high-protein dried distiller grains with solubles (DDGS), corn oil optimization, and new buyers for carbon dioxide. The ethanol plant of today will likely turn into the corn bio-refinery of tomorrow. Exports remain one area of optimism, but that optimism precariously hangs on China’s plans to convert to E10 blend gasoline nationally by the end of 2020. Higher-cost plants, or those with older technology, those that are smaller, or are located in areas with higher input costs, will be the first to exit the industry.