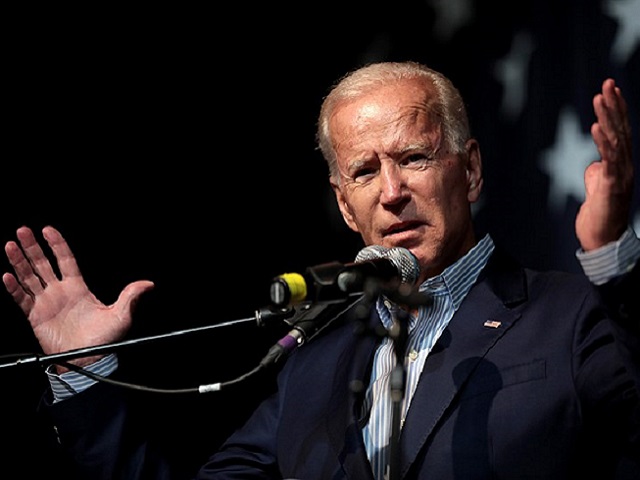

Biden Administration’s “American Families Plan” Concerning Agricultural Producers

WASHINGTON, DC – Last week, the Biden administration released a policy proposal called the “American Families Plan” which aims to expand benefits related to education, nutrition programs, and family tax credits by increasing or modifying several key tax provisions.

Among the most prominent proposals is an increase in the top marginal income tax rate from 37 percent to 39.6 percent according to the National Pork Producers Council (NPPC).

Additionally, capital gains taxes for households with over $1 million in annual earnings would see their capital gains taxed at income tax rates which changes the effective rate from the current 20 percent to the proposed 39.6 percent.

The administration also is proposing the elimination of the step-up in basis and levying capital gains taxes on assets when they are passed to another generation.

Biden’s plan, however, specifically exempts farm operations from this new capital gains tax, as long as the farm remains family-owned and operated.

(SOURCE: All Ag News)