Ag CEO’s Implore Administration to Address Supply Chains

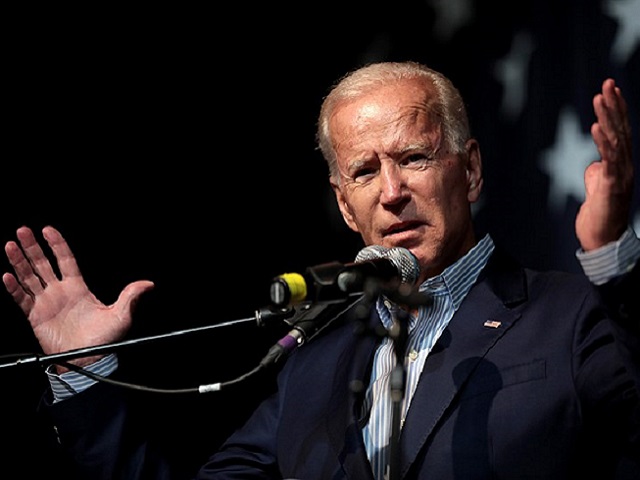

WASHINGTON, DC – Growing concerns over the effects of supply chain challenges have led the Ag CEO Council to ask the Biden administration to swiftly tackle issues causing higher prices and/or shortages for the ag sector.

In the letter signed by 17 top ag groups, the Council calls on the deputy assistant secretary for economic policy at the Department of Transportation to address nine areas of direct concern for the agriculture industry, underscoring how many of the current challenges are time-sensitive.

“After many years of low farm prices, recent price increases were poised to help elevate market net returns. Given these supply chain issues, that optimism has faded into a desire to simply not do worse than those lean years,” the groups outlined in the comments.

1. Labor: Labor shortages exist on the farm, in processing facilities, and among critical service providers. A National Council of Farmer Cooperative survey found that 77% of responding coops had issues retaining a skilled workforce during the pandemic. Federal food safety inspector shortages limit products that can be sold and shipped.

2. Barges: Hurricane Ida closed the Lower Mississippi River and grain unloading facilities in New Orleans. Grain shipping volumes and prices have yet to recover.

3. Ports and shipping containers: Import volumes have overloaded marine terminals, particularly on the West Coast. This has caused shipping delays, canceled bookings, and surcharges. Containers are leaving the U.S. empty rather than being filled and returned with agricultural products, as is normal practice.

4. Trucking and rail freight: More than 70% of all freight movement occurs on trucking and rail. Over the past 20 months, the transportation sector has experienced congestion, equipment shortages, and constrained capacity. General freight trucking prices increased by 21% since May 2020 and rail by 28% over the same period.

5. Fertilizer: A confluence of factors negatively impacting global fertilizer market supply chains include, (1) global demand for fertilizer, which is largely driven by crop plantings and prices; (2) recent weather events that disrupted domestic production; (3) COVID-19-related deferral of facility maintenance that is now being undertaken; (4) trade actions; (5) transportation costs; and (6) the supply and cost of natural gas.

6. Chemical inputs: Regulatory action by EPA is limiting the availability of pesticides necessary for agricultural production. Transportation issues are creating issues in product delivery, and Hurricane Ida has disrupted a critical region for herbicide production.

7. Energy: Energy during the early stages of the pandemic was primarily consumed at home. That abrupt change suddenly reversed, and gasoline prices have shot up more than 40% in the past year. Not only does energy affect fuel costs, but also it is an input for chemical, fertilizer, and seed production.

8. Equipment and parts: Steel prices rose dramatically during the pandemic due to both demand and tariffs levied on multiple steel products in August 2021. Also, a lack of microchips stemming from COVID-era demand for laptops and other home electronics has forced many farm equipment manufacturers to halt production, creating delays in shipping new equipment that sometimes lasts a year or more. In addition, parts needed to repair equipment may not be available.

9. Water availability: 75% of the Western U.S. and the Dakotas are in severe drought. Ranchers have had to liquidate portions of their herds, and irrigation costs have increased.

(SOURCE: All Ag News)