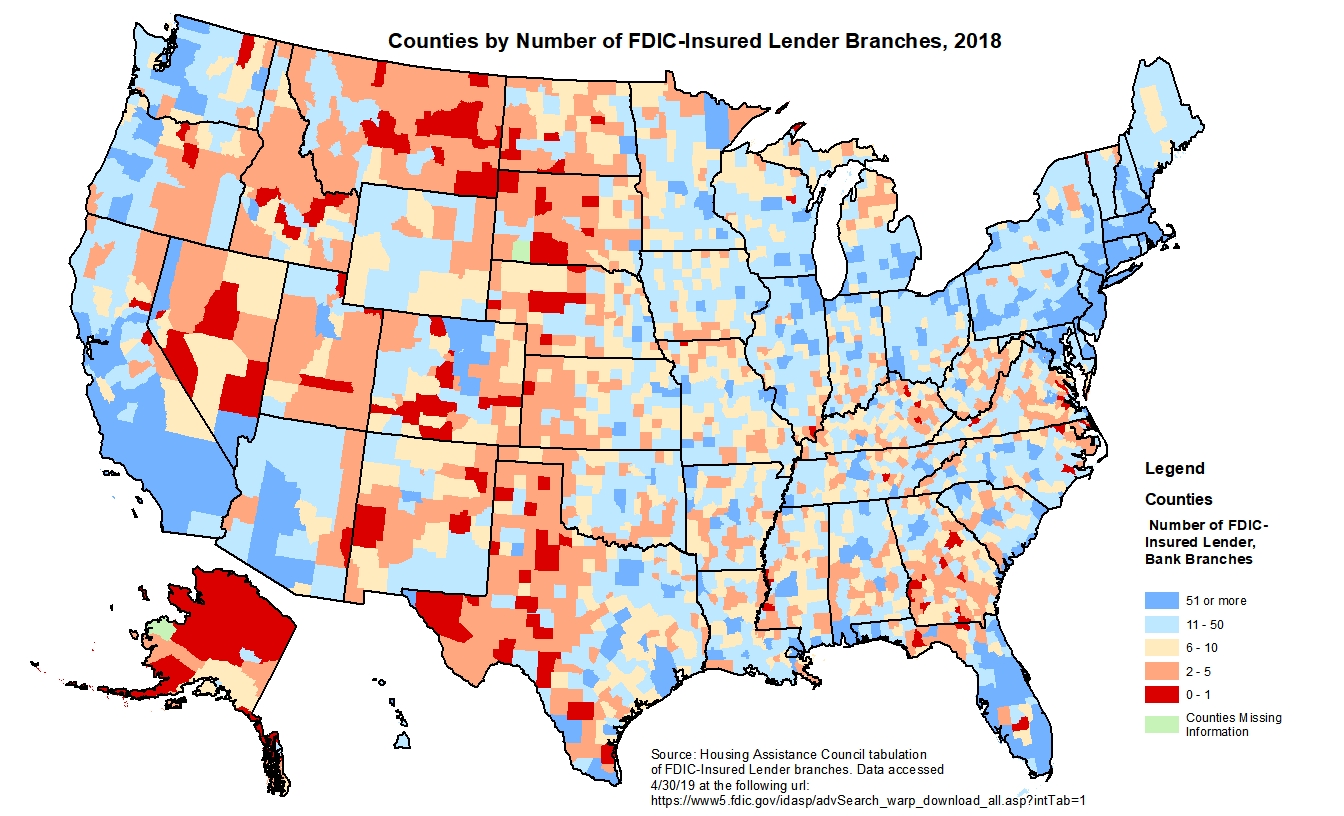

Rural Counties Most At-Risk for Bank Branch Closures

WASHINGTON, DC – What happens when a bank or banking branch closes in a rural county? According to a new report from the Federal Reserve, the groups most affected, at least in rural communities, appear to be older individuals, small business owners, those lacking reliable transportation, and those with lower levels of trust in the financial system. About 40 percent of rural counties experienced a net loss of banking branches from 2012 through 2017 and 39 counties nationwide were “deeply affected”. In those counties, there were ten or fewer bank branches in 2012 but five years later the county had half or fewer of the branches still in operation. The study shows that the most deeply affected rural counties were clustered primarily in the Southeast, Southwest, and upper Great Plains. Five urban counties were also considered deeply affected by branch closures. Also in those five years, there was a substantial increase in the number of communities that contained no bank headquarters, the majority of which were rural.