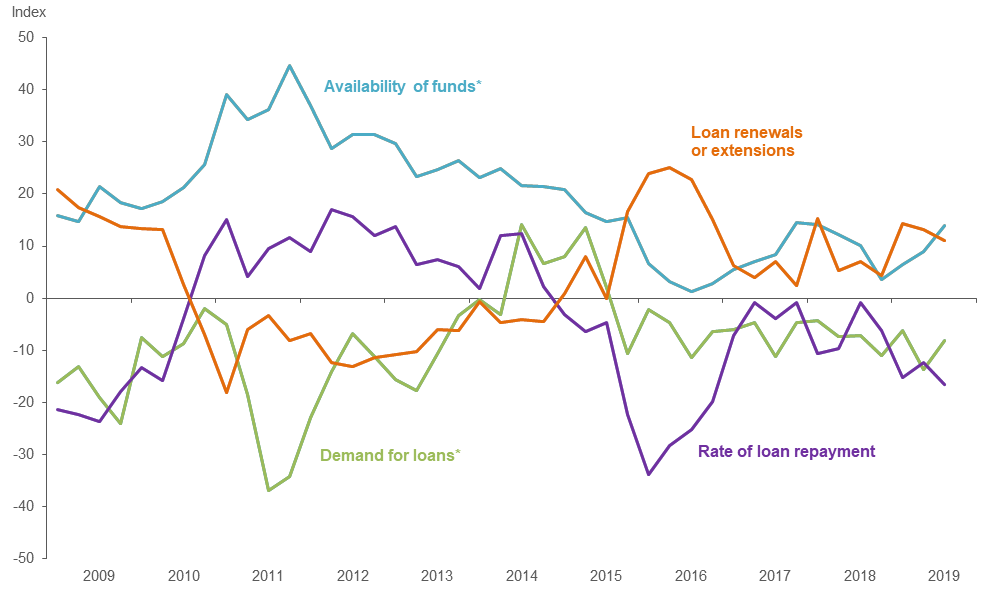

Southwest Region Dealing With Declining Loan Repayment Rates

DALLAS, TX – Demand for agricultural loans has declined in 2019, especially in Texas, northern Louisiana and southern New Mexico (also known as the Eleventh District of the Federal Reserve). Every quarter, the Dallas Fed asks bankers in the region about credit conditions and current agricultural trends. For the third quarter, just-released data shows the agricultural loan demand registering its 16th consecutive quarter in negative territory. Loan renewals and extensions continued to increase, and the rate of loan repayment declined to its lowest level since the end of 2016. With the exception of operating loans, which were mostly flat, loan volume fell across all major categories compared with a year ago. Overall, bankers reported overall weaker conditions across the most region, noting poor rainfall in the quarter contributed to extremely dry conditions, affecting crop yields, particularly corn, cotton, and wheat. Prices continued to be weak. In addition, the anticipated trend in farmland values was flat for a fourth consecutive quarter, suggesting respondents expect farmland values to hold steady. The credit standards index held steady at an elevated level, indicating a further tightening of standards.