Business Owners Uncertain About Future, Tax Concerns Increasing

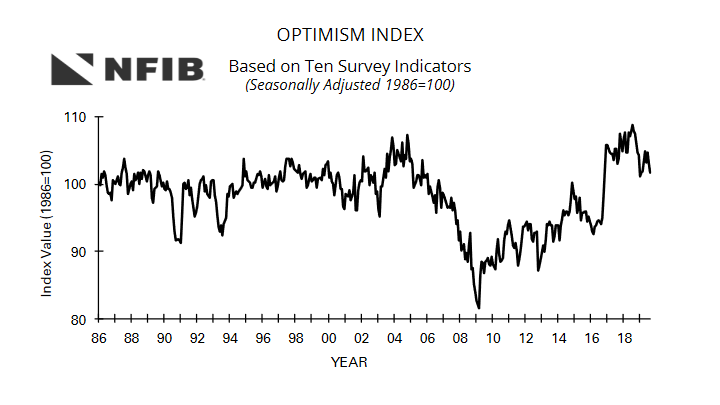

NASHVILLE, TN – Mumblings about a coming recession (or at least weaker growth) are becoming more prevalent according to the National Federation of Independent Business (NFIB). The NFIB Small Business Economic Trends reports that uncertainty is edging up. This means that more owners are unable to confidently make a statement about the future of economic conditions. As more owners become unsure, NFIB says caution will seep into business decisions. In the meantime, profit growth reports remain historically high. NFIB’s recently released survey of small business owners on the new tax law (Tax Cuts and Jobs Act, TCJA) found that the tax changes had a very significant impact on small firms, although the expected termination of the changes impacting small firms in 2025 is producing some planning concerns already. Over 80 percent feel tax reform had a significant impact on the economy and over 50 percent reported a positive impact on their business. Small business owners are anxious to have their tax cuts made permanent. NFIB’s 2016 Small Business Problems and Priorities survey found that five of the top 10 most severe problems facing small business owners are tax-related. The most severe of which is “Federal Taxes on Business Income.”