Expiring PTC Driving Large Year-end Wind Generation Construction

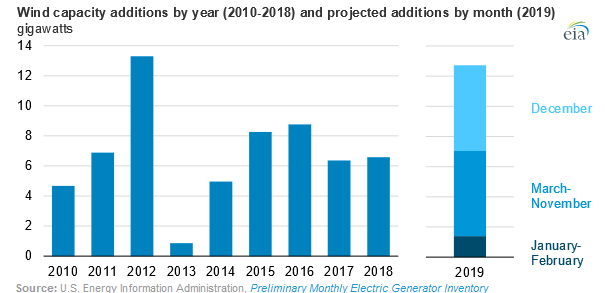

(WASHINGTON, DC) In 2013, Congress renewed the Production Tax Credit (PTC) for renewable wind generation in the United States. The PTC provides a maximum tax credit for wind generation of 2.3 cents per kilowatt-hour (kWh) for the first 10 years of production. Under phaseout, the tax credit decreases by 20 percentage points per year from 2017 through 2019. Facilities that begin construction after December 31st, 2019, will not be able to claim the PTC. Therefore, wind project developers who want to receive the full 2016 value of the PTC must begin operations by the end of 2020. However, based on the latest status report, more wind capacity is expected to come online by the end of this year than by the end of 2020. As in previous years, many of the annual wind capacity additions are expected to come online in the month of December. According to the U.S. Energy Information Administration (EIA), wind projects coming online this year total of 5.7 gigawatts (GW), or 44.7% of the 12.7 GW of new capacity added in 2019. If realized, 2019 would be the second-biggest year for new wind generation projects, trailing 2012 by less than one gigawatt (13.3 GW of wind capacity added in 2012). The high level of annual capacity additions in 2012 was driven by developers scheduling projects in time to qualify for a PTC that was expiring at the end of that year. Similarly, the increase in annual capacity additions for wind scheduled for 2019 is largely being driven by the legislated phaseout of the PTC extension for wind.